Nation's PE market showed tentative signs of recovery in 2024 after contracting during previous two years

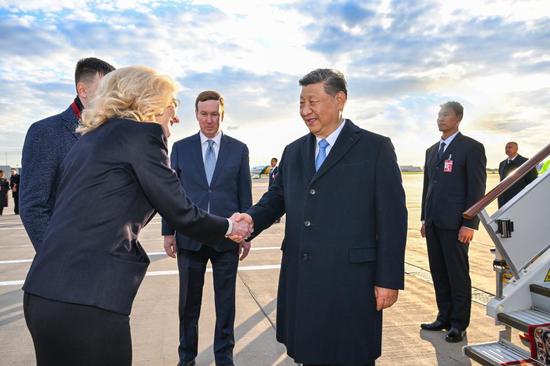

A large screen outside a building in Shanghai shows the closing index of the Shanghai A-share market on April 9. (WANG GANG/FOR CHINA DAILY)

While transformation of the Chinese private equity sector has been advancing for years, the process will pick up pace as the types of deals are changing and industry leaders are playing a bigger role when fundraising becomes more difficult, according to market experts.

To look on the bright side, China's PE market showed tentative signs of recovery in 2024 after contracting during the previous two consecutive years. According to a report released by market consultancy Bain &Company in late April, the overall PE deal value totaled $47 billion in 2024, up 7 percent from a year earlier.

The uptick was mainly supported by a rise in mega-transactions exceeding $1 billion each. These include the $8.3 billion buyout of Dalian Newland Commercial Management by a consortium including Abu Dhabi Investment Authority and the $2.8 billion buyout of Beijing Electronics IC Manufacturing by E-Town Capital.

About a decade ago, Chinese general partners of PE, or those who manage PE funds, used to focus on investing in smaller-sized startups. But now, they have pivoted from such traditional growth capital to buyouts, and the trend will continue as China's PE sector matures, explained Zhou Hao, head of Bain's Greater China PE practice.

The reasons for this transition vary. Apart from slower economic growth, increasing the installed base of PE owned by companies is another major reason for the shift, as this has led to more buyout opportunities. Furthermore, founders of the invested companies now prioritize professional management and scalability, thus showing a more open attitude toward buyouts, said Zhou.

Traditional growth capital has been dominating the Chinese PE market and this continued to take up about 60 percent of deals last year. This is quite different from that of mature markets, said Nancy Zheng, head of Bain's Greater China M&A practice. But changes have been gradually taking place in China since 2023.

As the number of buyouts increase, the requirements on GPs have become different. While growth capital can largely depend on the maturity of the market and GPs' judgement on a specific industry or company, buyouts need GPs to better empower the invested company and bring more returns to limited partners, or the fund providers, when they exit, she said.

In 2024, the top 10 GPs accounted for about 70 percent of fundraising, while the ratio was only 30 percent in 2020, as Bain &Co has discovered. Large GPs' proven track record and operational expertise will make them more competitive in the following years.

京公網安備 11010202009201號

京公網安備 11010202009201號